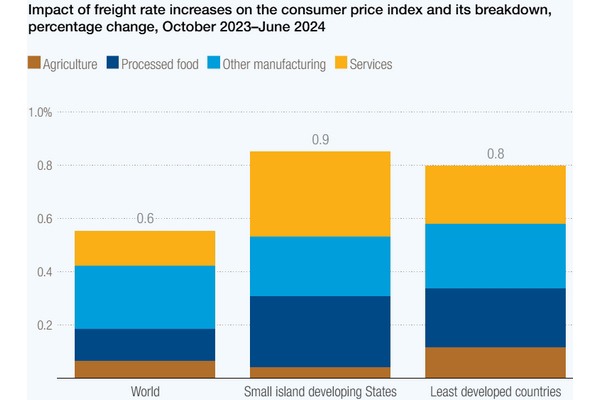

Disruptions in the Red Sea, Suez Canal, and Panama Canal have driven up shipping costs, sending shockwaves through the global economy.

Global shipping costs surged in the first half of 2024, driven by unprecedented disruptions in major maritime routes and rising operational costs. The strain on supply chains and economies is intensifying, with vulnerable small island developing States (SIDS) and least developed countries (LDCs) facing the worst impacts. As freight rates rise, so do concerns over trade sustainability, economic growth and the global effort to achieve sustainable development goals.

Freight rates soared amid route disruptions

Freight rates have skyrocketed in 2024 due to rerouted vessels, port congestion and higher operational costs.

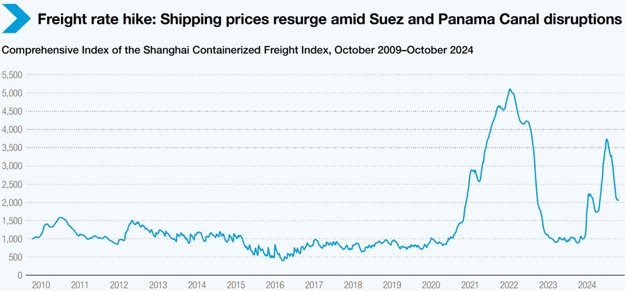

By mid-2024, the Shanghai Containerized Freight Index (SCFI) had more than doubled compared to late 2023. According to the latest available data, as of 18 October 2024, the SCFI was down 45% from its 2024 high and 60% below its record level during COVID-19. However, it remained 115% above the pre-pandemic average and more than double the 2023 average.

Beyond the primary trans-Pacific and Europe-bound routes, spot freight rates also surged. From January to July 2024, the average rate on the SCFI Shanghai–South America route more than doubled to $9,026 per twenty-foot equivalent unit (TEU), the highest level since September 2022.

During the same period, the SCFI Shanghai–South Africa route saw its average rate almost triple to $5,426 per TEU (the highest since July 2022), while the SCFI Shanghai–West Africa average rate jumped 137% to $5,563 per TEU (the highest since August 2022).

Disruptions in key routes through the Red Sea, Suez Canal, and Panama Canal have significantly increased freight rate volatility. Factors like increased shipping distances, heightened fuel consumption, and rising insurance premiums have all contributed to a "perfect storm" of cost pressures.

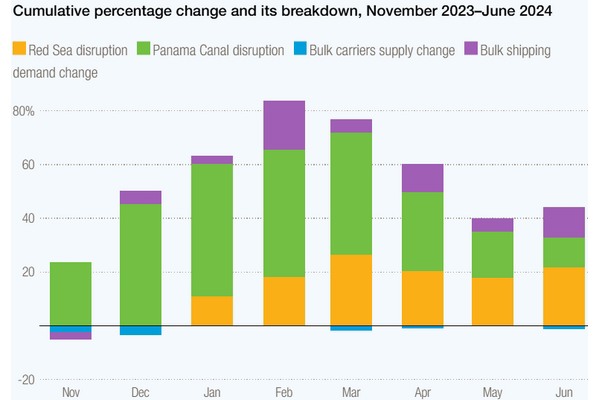

UN Trade and Development (UNCTAD) estimates show that disruptions due to climate-induced low water levels in the Panama Canal contributed 49 percentage points to the overall 45% rise in the Baltic Dry Index between October 2023 and January 2024.

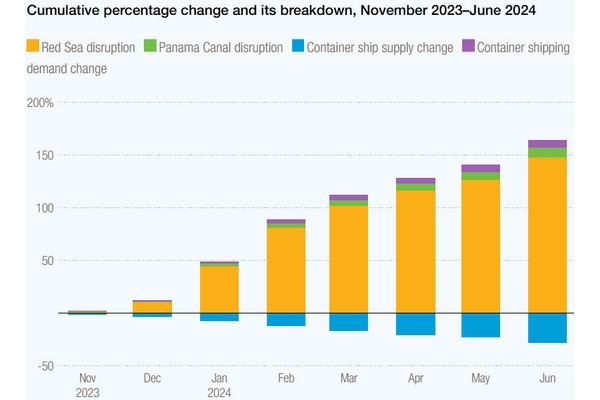

Similarly, the organization's calculations indicate that the Red Sea crisis and Suez Canal disruptions contributed 148 percentage points to the cumulative 120% increase in the China Containerized Freight Index from October 2023 to June 2024.

Overcapacity in container shipping has mitigated rate volatility, enabling the industry to accommodate increased demand. However, any further disruptions or spikes in demand could expose risks and increase freight rates, underlining the need for effective supply management to balance supply and demand.

For more information:

UNCTAD

Tel: +41 22 917 58 06

Email: [email protected]

www.unctad.org