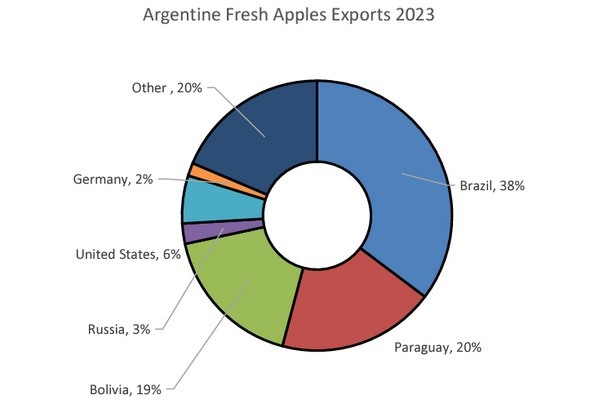

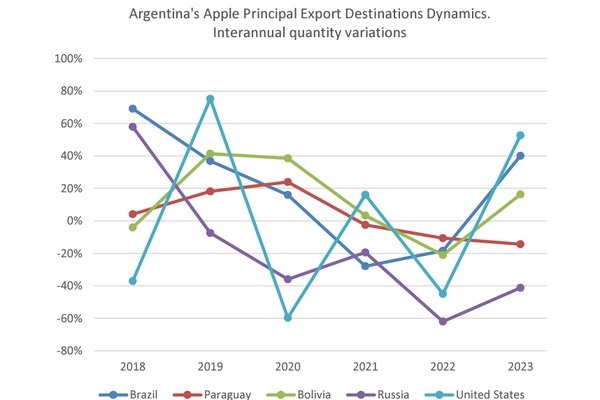

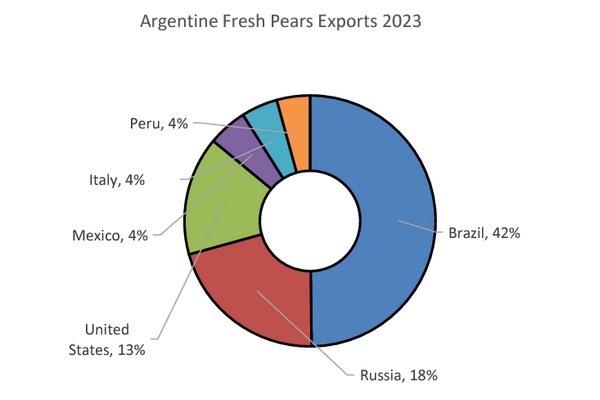

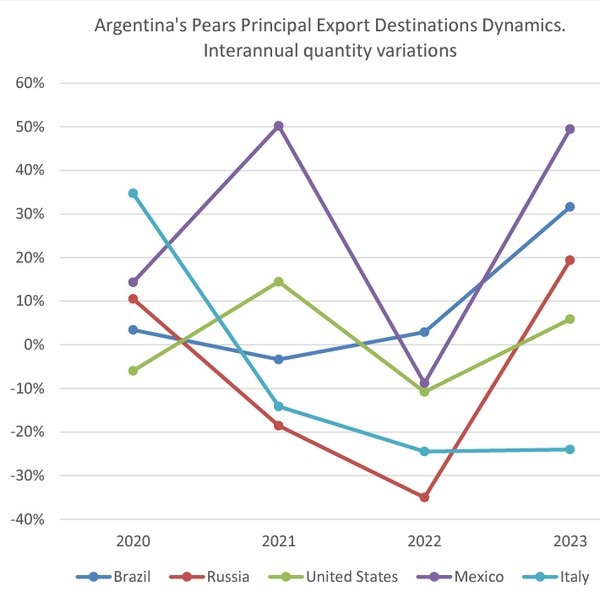

Post projects a slight increase in fresh apple production in Marketing Year (MY) 2024/25, forecast at 488,000 metric tons (MT), while pear production is expected to decrease to 655,000 MT from the previous year. Favorable weather conditions, with mild temperatures and scattered frosts, have not significantly affected crop development to date. Apple exports are anticipated to increase to 82,000 MT, whereas pear imports are projected to remain stable at approximately 330,000 MT, consistent with prior years. The number of fruit producers in the country continues to shrink, driven by escalating production costs, persistently low fruit prices, and increased competition for land from other sectors.

Río Negro province is the leading producer of apples and pears in Argentina. In 2022, it accounted for approximately 82 percent of the country's total production of these fruits, according to official national statistics. Neuquén province followed with 15 percent, while the Uco Valley in Mendoza Province contributed the remaining 3 percent.

The number of apple and pear producers in Argentina has significantly declined in recent years. According to the National Food Safety and Quality Service (SENASA), there were about 9,000 producers in 2005, but by 2023, that number had dropped to just 1,605 producers. This sharp reduction can be attributed to multiple factors, including rising production costs, urbanization of agricultural areas, and an aging workforce. However, the remaining producers in the industry tend to be more financially secure and stable.

One of the primary drivers behind the decrease in producer numbers is the rising cost of production. Land, water, and labor expenses have surged in recent years, making it increasingly difficult for small-scale producers to compete in domestic and international markets. The shrinking domestic market for apples and pears and declining international prices have also forced many small producers out of business.

To view the full report, click here.

For more information:

USDA

Tel: +1 (202) 720-2791

Email: [email protected]

www.usda.gov