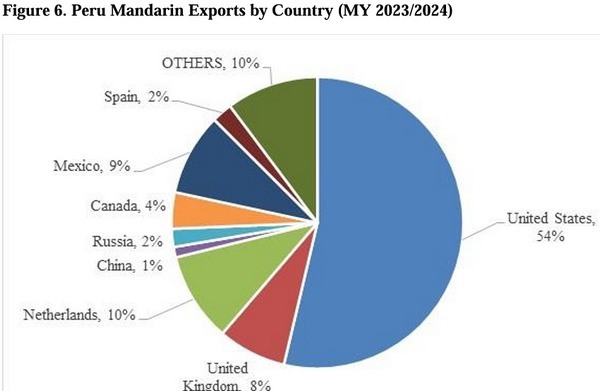

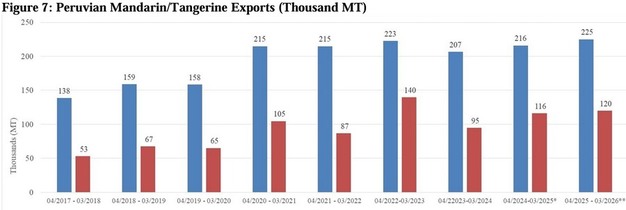

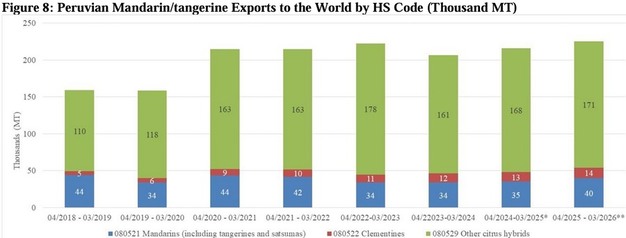

Peruvian mandarin/tangerine production and exports are expected to increase by two and four percent, respectively in MY 2024/2025 (April 2025 to March 2026). Production is forecast to reach 570,000 metric tons (MT), while exports are forecast at 225,000 MT. Higher productivity is driven by favorable La Niña climatic events contributing to below-average temperatures. Domestic consumption of fresh mandarins/tangerines is forecast at 320,000 in MY 2024/2025, a one percent increase from the previous year. The United States will likely remain Peru's top export partner.

Production

Mandarin/tangerine production in marketing year (MY) 2024/2025 (April 2025 to March 2026) is forecast at 570,000 metric tons (MT), an increase of two percent from the previous year. Cooler climatic conditions have extended into December 2024 due to the la Niña phenomenon, promoting favorable growing conditions into March 2025. With lows reaching 50 degrees Fahrenheit, the cooler weather has positively impacted plant flowering which will ultimately increase yields in March. In the absence of any negative weather shocks, production is expected to rise.

Historically, summer in Peru (December 2024 to March 2025) is the rainy season, however, rainfall along the coastal zone (where much of the mandarins/tangerines are produced) is expected to receive a low amount of precipitation. Mandarin/tangerine production will continue its upward trend.

According to official data, mandarin/tangerine production is primarily located in 13 regions (out of 25). Coastal areas account for 60 percent of total production due to the semi-tropical weather and good water availability (irrigation). Peru's main mandarin/tangerine producing area are the regions of Lima, accounting for 36 percent of total production; Junin, 29 percent; and Ica, 20 percent.

Peru is an active mandarin/tangerine producer and is looking to promote new royalty varieties to keep up with the global market. In the last eight years, early mandarin/tangerine varieties have been replaced by more profitable and higher-demand crops, such as avocados and grapes.

Production in Peru's Amazon basin and highland regions is primarily destined for the domestic market, while production in the valleys of Lima and Ica is predominantly export-oriented. Production in Lima and Ica benefits from desert-like conditions (reduced pest pressure, large daytime temperature variation) as well as close access to the major Ports of Callao (Lima) and Pisco (Ica).

Varieties in Peru include:

Satsumas (Citrus unshiu): Miowase, Clausellina, Okitsu, Owari, and Primosole. Clementines (Citrus reticulata): Clementines and Clemenules. Hybrids: Fortuna, Kara, Pixie, and Nova. Tangerines from Citrus reticulata and Citrus paradise: Murcott, Ortanique, and Tango.

For more information:

For more information:

USDA

Tel: +1 (202) 720-2791

Email: [email protected]

www.usda.gov