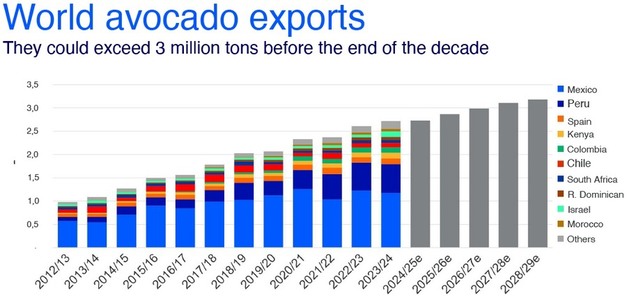

Over the last two decades, the global enthusiasm for avocados has surged, marking a notable presence in international trade. Despite potential challenges anticipated in 2025, agricultural economists project the demand for avocados to persist in the forthcoming years. According to Gonzalo Salinas, Rabobank's research director, global avocado exports are expected to ascend, potentially reaching a peak of 3.2 million tons by the 2028-2029 period. Salinas emphasizes the fruit's burgeoning prominence, predicting it to become the most traded fruit globally by 2030.

The expansion of avocado exporting countries from 14 in 2014 to 23 in 2023, with an expectation of hitting at least 30 by 2030, underscores the crop's growing international footprint. Despite this diversification, Mexico's leading position in avocado production remains unchallenged, with Peru and Colombia serving as supplementary sources during Mexico's off-season. This dynamic was highlighted in Salinas's keynote at the Global Avocado Summit in Santiago, Chile, which convened industry experts to deliberate on supply and demand dynamics.

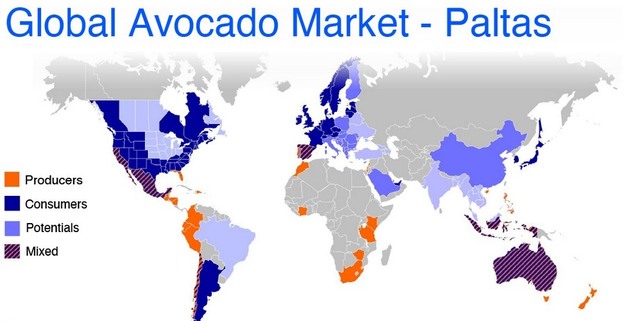

Consumption hubs in the UK/EU and the United States are recovering and expanding, with promising growth prospects identified in China, Saudi Arabia, Eastern Europe, and Sweden. Salinas points to potential in markets with intermediate consumption levels and those new to Hass avocados, including Southeast Asian nations, for further expansion.

However, trade dynamics face potential headwinds, such as the proposed tariffs by the U.S. on Mexican goods, which could affect prices during peak consumption periods. Despite these challenges, industry forecasts align with Salinas's long-term optimism. The Hass Avocado Board's Avocado Forum in Carlsbad, CA, further explored resource needs for the industry's future competitiveness, with Mexican agricultural analyst Ramon Paz predicting significant growth in Mexican avocado imports to the U.S. by the 2029-2030 season.

Mexican strategies aim to bolster consumption in the U.S. market while promoting the Avocados from Mexico brand, with a vision of a unified North American market. Meanwhile, concerns over U.S. dependency on Mexican avocados and the need for supply diversification were voiced by Eric Imbert of CIRAD, highlighting the impact of climate change and the importance of market promotion for stability.

With the EU/UK markets poised for growth and Asia presenting vast opportunities, the global avocado industry stands at a critical juncture. Investments in promotion and consumer education are deemed essential for tapping into these emerging markets and ensuring the continued vitality of the avocado trade.

Source: AJOT Insights