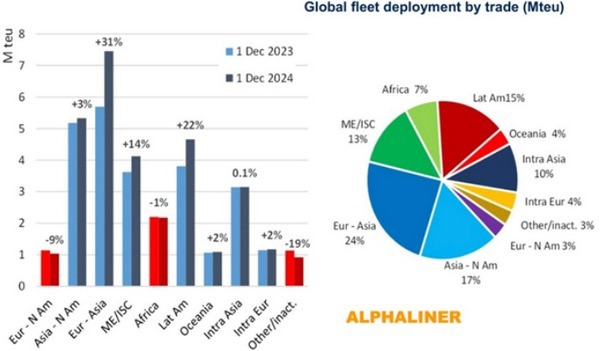

The global container fleet has seen an expansion, with almost three million TEU slots added over the past 12 months, as reported by Alphaliner. A substantial portion of this increased capacity, approximately 1.76 Mteus or 59%, has been utilized by the Asia-Europe trade. This surge in demand for additional ships is attributed to the rerouting of services via the Cape of Good Hope, a strategic move to bypass the hazardous passage through the Red Sea.

Alphaliner's analysis reveals that, as of June, the year-on-year capacity growth for this trade lane was 24%, escalating to 31% six months later. Despite this growth, the weekly capacity offered on the Asia-Europe route has increased by a smaller margin due to the rerouting's capacity absorption. As of December 1, 2023, the weekly average was 434,940 slots, which saw a modest rise of 38,360 TEUs or 8.8% by December 1, 2024.

The industry faced concerns over potential overcapacity in 2024. However, the diversion of ships around the Cape has significantly mitigated this issue, leaving only 0.6% of the total container ship fleet commercially inactive by the year's end. Alphaliner characterizes 2024 as a landmark year due to the Red Sea crisis, contrasting it with the preceding Covid-19 years.

Looking ahead, major container lines are preparing for network changes that could extend the rerouting around South Africa's Cape Peninsula into the latter half of 2025. According to Lars Jensen, CEO and partner at Vespucci Maritime, the resumption of services through the Suez Canal will require substantial network adjustments. He predicts a period of network instability as shipping lines phase in their new networks during the early months of the year.

Jensen also highlights the reluctance among carriers and shippers to resume Red Sea crossings prematurely. The disruption caused by reverting to Red Sea routes, as experienced by Maersk, has led to a cautious approach. Shippers, in particular, express concerns over the risks associated with Red Sea passages, including the potential for general average declarations due to Houthi attacks. Despite the longer transit times, the stability offered by the Cape route remains preferable to many.

However, Jensen suggests that once the threat in the Red Sea diminishes, competitive pressures will likely drive a return to the Suez Canal route, offering quicker and more cost-effective shipping options for shippers.

Source: Freight News

Source: Freight News