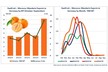

The U.S. Department of Agriculture Foreign Agricultural Service (USDA/FAS) has released projections indicating a downturn in Argentina's orange and tangerine production for the 2024–25 cycle. Orange output is expected to drop to 620,000 metric tons (MT), a reduction from the previous year's 760,000 MT. Similarly, tangerine production is anticipated to decrease to 200,000 MT from 280,000 MT.

In Argentina, the cultivation of sweet citrus spans the northwestern and northeastern regions, with a variety of oranges and tangerines grown across these areas. Notably, the northwestern region produces Hamlin, Pineapple, Robertson, and Navel oranges, while the northeast is known for Navel, Salustiana, and improved Valencia varieties such as Midknight and Delta Seedless. Tangerine varieties include Clementina, Clemenvilla, Ellendale, Malvasio, Montenegrina, Murcott, and Ortanique.

The forecasted planted area for the 2024–25 season remains static at 37,000 hectares for oranges and 26,900 hectares for tangerines, reflecting a stagnation in area expansion due to the lack of significant investment in recent years.

Additionally, the volume of oranges and tangerines allocated for processing is expected to decline, with oranges projected at 220,000 MT (down from 231,000 MT) and tangerines at 40,000 MT (down from 50,000 MT).

The trade outlook for 2024–25 suggests a decrease in fresh orange and tangerine exports, with oranges expected to reach 52,000 MT (down from 61,600 MT) and tangerines at 20,000 MT (down from 33,600 MT). The decline in exports is attributed to challenging economic conditions and increased competition from Southern Hemisphere nations such as South Africa, Peru, Chile, and Uruguay. The pursuit of the U.S. market has become a priority for Argentina amidst dwindling options in other markets.

Projected imports of oranges into Argentina are set to decrease to 2,000 MT, with tangerine imports anticipated to remain steady at 1,000 MT for the 2024–25 period.

Source: Citrus Industry