Extreme weather and geopolitical tensions made 2024 a challenging year for the Dutch fruit and vegetable sector.

In 2024, it became clearer than ever that the continuous availability of fruit and vegetables cannot be taken for granted. Despite the challenges, the sector showed resilience. With rising imports and growing sales abroad, Dutch trade once again proved to be a reliable partner for European retail and wholesale, reports GroentenFruit Huis.

Strong trade performance

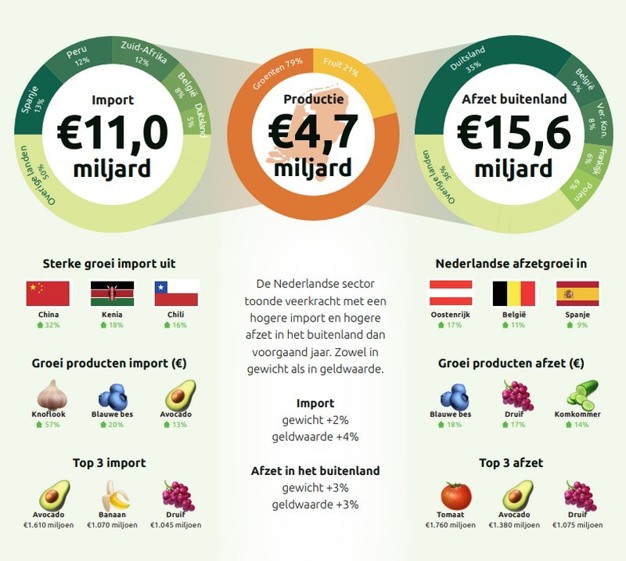

Dutch fruit and vegetable production was worth €4.7 billion in 2024. In addition, imports rose by 4% to €11.0 billion, and exports were 3% higher than in 2023, with a total export value of €15.6 billion.

Major source countries for imports were Spain, Peru, and South Africa, but notable growth was achieved from countries such as:

- China (+32%), mainly due to increased supply of garlic and ginger.

- Kenya (+18%), especially avocados.

- Chile (+16%), with products such as blueberries, grapes and kiwis.

The top three imports were avocado, banana, and grape. Products with notable growth rates in both volume and value included garlic, blueberries, and avocado.

Exports largely focused on Germany (35%), Belgium (9%), and the UK (8%). Products such as blueberries, grapes, and cucumbers significantly boosted export value. Strong growth rates were achieved in Austria (+17%), Belgium (+11%), and Spain (+9%), with grapes, avocados, and tomatoes contributing notably to growth.

Worrying drop in consumption

Fruit and vegetable consumption in the Netherlands fell by 3% in 2024, divided into 2% fewer vegetables and 4% fewer fruits. Dutch people ate less outside and did not compensate by eating more fruit and vegetables at home. Both home consumption and consumption in restaurants and catering were lower than in 2023.

This leaves Dutch consumption well below the Nutrition Centre's recommended daily allowance of 250 grams of vegetables and 200 grams of fruit. The average Dutch person consumes only 60% of this standard.

Price development below inflation level

Vegetables and fruit were on average only marginally more expensive in 2024 than a year earlier. According to CBS figures, prices of fresh vegetables rose by 1.3% and fresh fruit by 2.7%. Both were well below the average price inflation of 3.3% for goods and services in the Netherlands.

Trade association GroentenFruit Huis notes that rising chain costs for energy and labour, for example, are not always passed on to consumers, keeping prices low. This puts increasing pressure on purchase prices, also because retailers often use fruit and vegetables as tools in pricing policy and promotions.

A sector that continues to perform

"Despite declining domestic consumption and challenging conditions, the Dutch fruit and vegetable sector has once again demonstrated its resilience and strong position in the international market. However, it remains worrisome that Dutch consumers are becoming increasingly distanced from healthy food recommendations. The sector will continue its commitment to sustainable production, healthy choices, and reliable availability, aiming to encourage consumers to eat more fruit and vegetables: the healthiest food with the lowest environmental footprint."

For more information:

GroentenFruit Huis

Louis Pasteurlaan 6

2719 EE Zoetermeer

+31 (0)79 368 11 00

[email protected]

www.groe ntenfruithuis.nl