Delivery of significant amounts of lower-grade stock to the value-added manufacturers of Turkiye has led to January sales volumes in the Australian almond industry. Processors will finish the 2024-25 season with one of the lowest carry-outs in history as they clear warehouses of all inventory at attractive pricing.

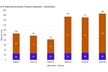

Against a marketable crop (including carry-in) January's figures push the net sold position to 94.5% with month of figures to be delivered. It is the high net sold position in the past 10 years. The total volume sold for the 2024-25 season is 163,444 tons, up 30% on the same time last year. Exports are up 32% with China, India, Europe, and the Middle East leading the way.

Indonesia has emerged as a potential growth market, up 172% and with almost 2000 tons for the season. Anecdotal feedback during early season harvest that nonpareil yields have been under pre-season expectations is also likely to increase buying interest as established customers try to lock away volumes of this popular variety.

News that China has imposed a further 10% tariff on California almonds will drive further interest in Australian almonds from buyers in this market. Australia has become China's number one almond source despite being only 10% of world production.

This geo-politic news has been tempered by speculation in Delhi last week that the US and India may do a trade deal on agri-food commodities including almonds in the not-too-distant future. Australia currently enjoys a 50% tariff advantage over Californian almonds in India due to the AI-ECTA deal two years ago.

To view the full report, click here.

For more information:

For more information:

Australian Almonds

Tel: +61 (0)8 8584 7053

Email: [email protected]

www.almondboard.org.au