At the recent Tomeet congress, organized by Rijk Zwaan in Almeria, Carmen Cabrera, from the Cajamar Foundation, made an analysis of tomato production in the Mediterranean arc and its development over the last 50 years and mentioned the largest producers and exporters in the region.

© Marta del Mooral Arroyo

© Marta del Mooral Arroyo

One of them is, of course, Almeria. 40% of the GDP of this Spanish province corresponds to agriculture, and in the 2023/24 season, it produced 3.8 million tons of vegetables worth 3,000 million euros in some 33,600 hectares of greenhouses.

© Marta del Mooral Arroyo

© Marta del Mooral Arroyo

Intensive greenhouse agriculture began to be deployed in Almeria in the 1970s, and thanks to the growing conditions and saline characteristics of the water, tomatoes quickly became the most important vegetable in the province.

However, after several decades of expansion, 2016 marked a turning point in the growth of the tomato acreage, entering a phase of decline that has caused it to lose its position as the leading crop in the province in terms of acreage. In fact, in the last 50 years, the share of tomatoes in Almeria's total agricultural acreage has dropped from 50% to 20%.

"There are several reasons for this development," says Carmen. On the one hand, the higher costs include the rising minimum wage and the growing tendency of farms, which need to hire more laborers, or the greater expenses involved in growing specialties. On the other hand, the growing competition in the market has also had an impact," she said while showing a slide with the development of EU imports (in tons) since the early 2000s. "One of the most remarkable things has been the increase in the volume of tomatoes grown in the EU (in tons) since the beginning of the 2000s.

© Marta del Mooral Arroyo

© Marta del Mooral Arroyo

"One of the most remarkable facts revealed in the graph is that in 2002, the Netherlands stood below Spain; however, in this context of strong competition, the country has managed to reinvent itself, and today it leads the tomato market in the EU," she said.

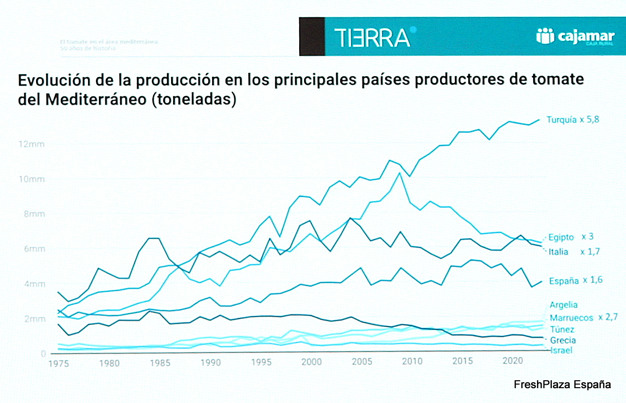

What has happened in the last 50 years with the Mediterranean production?

While Spain's volumes have been decreasing, Morocco has kept growing and reached Spain's tomato figures. "Although Morocco is not the biggest tomato producer in the Mediterranean, it has a great exporting vocation, since it exports 45.6% of its production and, in fact, the volume of Moroccan tomato exports has increased fivefold since 1986."

"The undisputed leader in tomato production in the Mediterranean-growing countries is Turkey, with almost 13 million tons a year. What's even more impressive is that Turkey's export volume only represents 5% of its production, but it's still on a par with that of Spain or Morocco."

© Marta del Mooral ArroyoSlide from the presentation

© Marta del Mooral ArroyoSlide from the presentation

Until 2015, more than 60% of Turkish tomato exports went to Russia. From 2016 onwards it had to diversify its shipments to Eastern European countries, although its shipments to Russia have gradually recovered. "Turkey has a large domestic market, but given the current geopolitical situation, it may increasingly prefer to export to Europe," says Carmen.

"As for Egypt, its production peaked in 2009, and after that, it has been declining, possibly due to the country's internal situation. At the moment, it's only exporting around 1.2% of its tomatoes, but exports might still turn for the better in the next few years."

"Given all this, we can only expect Spanish tomatoes to face growing competition, so the country will need to boost its competitiveness. How? By increasing profitability: increasing productivity, reducing costs, opening up new markets and offering new products; but, above all, by trying to meet the market's needs," she said.

© Marta del Mooral Arroyo

© Marta del Mooral Arroyo

"More efficient management can help minimize costs, and automation can help reduce the need for labor, which today represents 45% of total production costs. This is not about eliminating jobs, but about labor focusing on higher value activities, which could go hand in hand with higher wages and attracting more skilled young people to the sector.

"Training, investment, and innovation will be necessary for the tomato sector to have a future," said Carmen.