Moldova may be one of the smallest countries in south-eastern Europe, but when it comes to fresh produce exports, it is the region's second-largest, after only Serbia. And regarding fruit, no country in the area does better: Moldova exported nearly €240 million worth of fruit in 2023. For vegetables, it recorded a modest €10 million in overseas market earnings, TradeMap data tells us.

Cultivation-wise, too, the fruit/vegetable ratio is entirely skewed in favor of the former. Moldova harvests about five times more volume of fruit than vegetables. Of the 12 other Southeast European countries, only Romania and Serbia grow more fruit than Moldova. Apples take the crown: with over half a million tons, apples account for three-quarters of Moldova's fruit yield. In second and third place are stone fruit (especially plums) and grapes.

In exports, apples claim two-thirds of the pie. Some 40% of Moldova's apple yield goes abroad, 95%, until recently, to Russia. Moldova has long focused on a single crop and destination: apples and Russia, and losing that market was disastrous for Moldova's horticultural sector.

The Soviet era's legacy

According to Iurie Fala of the sector organization Moldova Fruct, by the end of the Soviet era, there were 400,000 hectares of horticulture in Moldova that supplied the Soviet Union with mainly fruit and tomatoes. "We were the Soviet Union's fruit basket. We used to harvest about one million tons of apples," he says.

"After the collapse of the Soviet Union, cultivation came into the hands of private companies. Russia was a consolidated, easy market for us. Our growers, almost all of whom speak Russian, had many contacts there. We could sell all our apples in Russia, from extra quality to Class II. Until 2021, we also shipped about half of our export grapes and plums there."

Moldovan farming and trade have always been significantly fragmented, a state party perpetuated by the convenient Russian market. "We didn't have to cooperate to supply, for example, the big European supermarkets. The embargoes gradually changed that," says Iurie.

There have been three Russian bans, which, though always politically motivated, were imposed on so-called phytosanitary grounds. The first was introduced in 2004, the second in 2014, not coincidentally after the signing of a trade agreement between Moldova and the E.U., and the third, still in force today, in 2022.

Market diversification

Especially since 2022, fruit exporters have increasingly shifted their gaze to the lucrative, easily accessible markets in the European Union, Middle east, India, and other Asian countries. However, exports to the latter destinations took a hit last year due to the situation in the Red Sea. Some Moldovan fruit also still finds its way to traditional destinations: the former Soviet republics.

Moldova is even still exporting mostly apples to Russia via Transnistria. This Russian-speaking strip of land is, for now, still officially part of Moldova and thus adds to the country's statistics, and is not covered by the export ban, nor are some neighboring districts and Moldovan companies that have a P.O. box there. Exports also happen through (more expensive) unofficial channels in countries like Belarus and Kazakhstan.

Also, you should note that fruits and vegetables from Poland and other E.U. countries continue entering Russia through loopholes. Regardless, transportation from Moldova to Russia is cumbersome and expensive - transit via Ukraine is no longer an option - so there is a pressing need to diversify export markets.

Fluctuating apple harvest

Recent Moldovan apple exports have fluctuated considerably, in line with the crop size: each season from 2018/19 to 2023/24, that was 297,000 tons, 237,300 tons, 158,400 tons, 257,900 tons, 125,200 tons, and 133,000 tons, respectively. The last two seasons' figures partly reflect the Russian embargo. Half of the apples are generally destined for the processing industry, 15% for local consumption, and 35% for export.

Last season, exports to the European Union amounted to 22,000 tons, 90% of which were sold on the Romanian market. According to Moldova Fruct numbers, the biggest buyers in the first half of this year were Russia (just over 50,000 tons), Romania, Belarus, Saudi Arabia, and Kazakhstan. A 450,000-ton harvest is expected this fall. That is 14% less than last year due to climate-related issues and acreage reduction.

Moldova remains tasty grape variety

Moldova exported 84,000 tons of 2023's grape crop, much more than 2022's harvest of 57,000 tons. The E.U., with Romania and Poland in the lead, took half of the grapes Moldova sold overseas. That is 15 percentage points more than the 2022 35% market share. There were also exports to the Baltic states, countries like the Netherlands and Germany, as well as to the U.K., the United Arab Emirates, and Hong Kong.

As much as 80% of the export grapes are of the Moldova variety, a pitted grape that many love for its exquisite taste. Water stress means this season's crop could be down as much as 35% from 2023. Damage from cyclone Boris, which swept Central Europe in mid-September, could add to that loss rate.

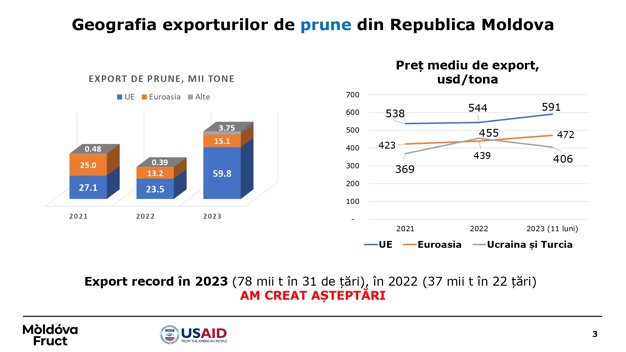

Geography of exports of plums from the Republic of Moldova (1.000 tons) and average export price (USD/ton). The export reached 31 countries in 2023.

Plums on the rise

In May, vice-premier Dumitru Alaiba said that, in 2023/24, Moldova exported almost 60,000 tons of plums to the European Union, four times the quota valid until the summer of 2022. According to Moldova Fruct figures, 22% was destined for Romania, 16% for Poland, 10% for Germany, and eight percent for the Czech Republic. The remainder was distributed to the remaining E.U. countries.

These sizable exports were also 2.6 times up from 2022/23 and more than competitors such as Spain, South Africa, and Italy had marketed in the European Union. Although some 15,000 tons were exported to Eurasian countries, the focus is increasingly shifting to the E.U. The drought will impact plum production, too, making for lower-than-usual harvest figures this year, with yields estimated at 90,000 tons.

Cherries, apricots, and walnuts

Last season, Moldova also shipped 2,300 tons of cherries to the European Union. That share was 17% of the total exports and 16 percentage points more than in 2021. The main destination was Romania, but there were also decent sales to Poland, Latvia, the Netherlands, and Germany.

The country sent 7,500 tons of apricots to the E.U. market, mainly to Romania, Poland, Latvia, Croatia, and Germany. As a destination, the European Union accounted for over 55% of Moldova's apricot exports, and exports to this bloc were up 24% from 2023.

In the first seven months of 2024, Moldova exported over 7,000 tons of walnuts to the E.U., almost double that of the same period in 2023. Most go to Germany, followed by Romania and France.

The E.U. countries export fruit and vegetables to Moldova, too, though those are less than imports. In 2022, those exports amounted to barely 50,000 tons, mainly potatoes, citrus, and cabbages.

Moldova Fruct website

So, two introductory articles with some general information on the country and its fresh produce sector. Over the next few days and weeks, a dozen or so growing and exporting companies, a retailer, a distributor, an importer, and a transport company will share their experiences of the past few years, what opportunities they see on the international market, and what they are currently up against in their daily operations.

In the meantime, you can take a virtual tour of 20 companies on the Moldova Fruct website. There are beautiful photos and a short video of orchards and storage and sorting facilities. You will also find brief information about the area, tonnage and varieties grown, as well as the various farms' locations on the map of Moldova. Interested importers can even select farms based on the varieties grown. For example, we counted 27 varieties of plums and as many as 39 of apples.