In a groundbreaking development for the agricultural trade sector, the United States Department of Agriculture (USDA) has announced a pivotal update in import regulations set to significantly impact the table grape industry. As of July 2024, specific regions in Chile, recognized for their low prevalence or absence of the European grapevine moth, have been greenlit to export table grapes to the U.S. under new, less stringent requirements. This strategic move not only aims to safeguard U.S. agriculture from the threat of the Chilean false red mite but also marks a significant shift towards reducing the reliance on methyl bromide, a potent fumigant with environmental repercussions. The updated regulations are expected to bolster the competitiveness of Chilean table grapes on the global stage.

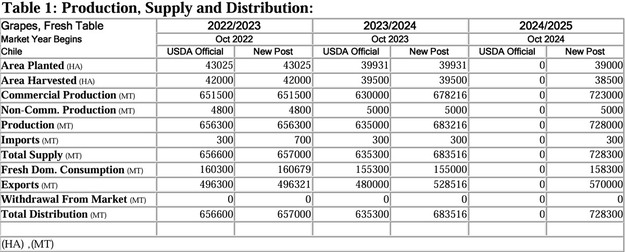

Forecasts for the Marketing Year (MY) 2024/25 indicate a promising outlook for Chile's fruit production and export capabilities. Table grape production is projected to see a 6.6 percent increase, reaching a total of 723,000 metric tons (MT), driven by high yields. This surge in production is anticipated to propel exports up by 7.8 percent, totaling 570,000 MT. The apple and pear sectors are also set to experience growth, with production and export figures showing positive trends. This article delves into the implications of the USDA's recent policy update, exploring its potential impacts on Chile's fruit export industry and the broader agricultural trade dynamics between Chile and the United States.

In MY 2024/25, Post estimates table grape production will increase by 6.6 percent, totaling 723,000 MT due to high yields and assuming no unexpected climatic events that could hinder production. Table grape yields will increase due to favorable climatic conditions, such as abundant rainfall and a high accumulation of chill hours in the winter.

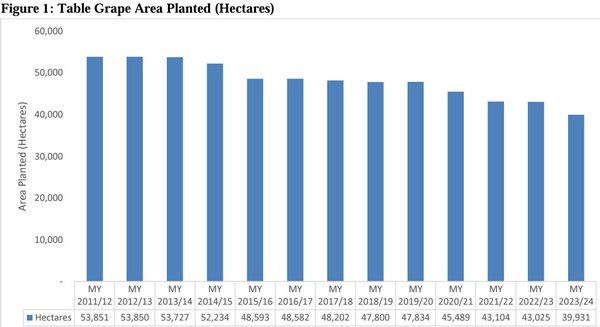

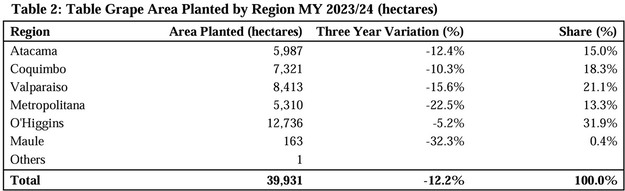

In MY 2024/25, Post projects a 2.3 percent reduction in the area planted with table grapes, bringing the total to 39,000 hectares. The area dedicated to table grapes has been declining for over a decade due to narrow profit margins. Increased competition from other suppliers and low prices for traditional varieties like crimson, flame, and red globe have forced smaller table grape exporters out of the market.

Data from the Chilean Ministry of Agriculture's Office of Policy and Studies (ODEPA) indicates a decrease in the area planted with table grapes across all production regions in Chile. The northern Atacama region has seen a particularly sharp decline due to low prices and high production costs, including labor, transport, and chemical products. Grapes from the Atacama region face intense competition from Peruvian grapes in the U.S. market, which drives their prices down. Nationwide, the demand for new grape varieties further tightens profit margins, as renewing grape orchards requires a significant investment from producers.

To read the full report, click here.

For more information:

USDA

Tel: +1 (202) 720-2791

Email: [email protected]

www.usda.gov