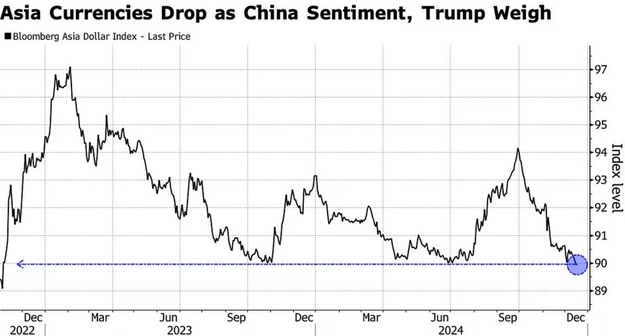

An index tracking Asian currencies against the US dollar has reached its lowest point in over two years, driven by concerns over China's economic prospects and the potential impact of policies from the incoming Trump administration. The Bloomberg Asia Dollar Index declined to 89.9091, marking a decrease of over 4% since the end of September and signaling the poorest quarterly performance in this period.

The weakening sentiment towards Asian currencies is attributed to China's inadequate actions to support its economy, affecting the yuan and consequently its regional counterparts. The threats of tariffs from President-elect Donald Trump, diminishing expectations for rate cuts in the US, and political instability in South Korea have further undermined confidence.

Ken Cheung, a strategist at Mizuho Bank in Hong Kong, noted, "The double whammy of US tariff threats and higher dollar path are keeping Asian currencies under selling pressure. Mounting political uncertainties in Korea is adding fresh fuel on won selling, and that's dragging other Asian currencies lower too."

Recent economic data from China has indicated a sluggish recovery, with indicators such as retail sales in November underperforming expectations. In South Korea, the political landscape has impacted the won, with the market's attention on President Yoon Suk Yeol's impeachment case. The Indian rupee and the Indonesian rupiah have also seen declines, with the rupiah crossing a significant threshold against the dollar.

Decisions on interest rates by central banks in Indonesia, Thailand, Taiwan, and the Philippines are anticipated this week. While a rate cut is expected from Bangko Sentral ng Pilipinas, Bank Indonesia might maintain rates, albeit with a minority of analysts predicting a reduction.

The dollar's strength since Trump's victory, attributed to his "America First" stance and persistent inflation, poses additional challenges for Asian currencies. The Bloomberg Asia Dollar Index, which measures nine Asian currencies against the dollar, highlights the impact on the Chinese yuan and South Korean won.

Mitul Kotecha, head of Asian FX and EM macro strategy at Barclays Bank, remarked, "Sentiment has soured amid a generally buoyant dollar backdrop. Dollar positioning does not appear overly crowded at present and the potential onset of tariffs is expected to keep the dollar supported against Asian FX."

Source: BNN Bloomberg