Fresh fruit imports in Bangladesh have been on a downward trajectory, impacted by various duties, currency depreciation, and inflationary pressures. Importers cite increased duties on fruits like apples, oranges, grapes, pears, citrus, and pomegranates as a key factor in declining consumption, positioning these fruits as luxury items.

Md Serazul Islam, president of the Bangladesh Fresh Fruits Importers Association (BFFIA), highlighted that the cost of imported fruits has surpassed the purchasing power of average consumers. "The prices of imported fresh fruits went beyond the buying capacity of regular consumers due to various duties, depreciation of taka, and inflation," he stated.

Importers face a compounded cost structure. For a fruit unit costing Tk 100 (approximately $1.15), tariffs exceed Tk 136 ($1.56), and additional transport and shipping costs elevate the price to Tk 250 ($2.87).

Bangladesh Bank data reveals a 31% depreciation of the taka against the US dollar from June 2022 to March 2025. The exchange rate shifted from Tk 93 ($1.07) to Tk 122 ($1.40) during this period. Concurrently, inflation rates have remained above 9% since March 2023, with an average of 10.34% in 2024, slightly decreasing to 9.94% in January 2025.

Customs duty for fruits increased from 89.32% in FY 2021-22 to 113.80% in FY 2023, currently standing at 136.20%. Duties include a 30% supplementary duty, 20% regulatory duty, 25% customs duty, 15% VAT, 10% advanced income tax, and 5% income tax. A 20% regulatory duty was introduced in mid-2022 to discourage imports and stabilize the foreign exchange market.

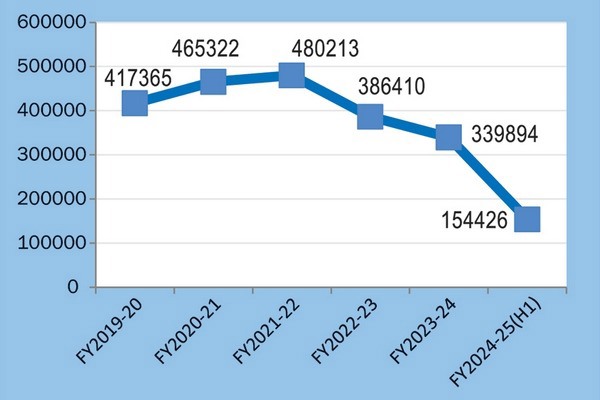

Import volumes reflect these challenges. FY 2024 saw 339,894 tons of fresh fruits imported, down from 417,365 tons in FY 2020. Ramadan typically boosts fruit consumption, but traders remain cautious due to waning demand.

The BFFIA reports that only 40% of fruit demand is met locally. Bangladesh imports 38 fruit varieties from 22 countries, with apples, malta, oranges, grapes, and pineapples comprising 95% of imports. Major suppliers include China, South Africa, India, Egypt, Bhutan, Brazil, Australia, and New Zealand.

Importers have protested, urging the National Board of Revenue (NBR) to reduce duties, arguing that the regulatory duty is currently irrelevant. The NBR has indicated potential action in the upcoming budget.

Chattogram wholesale traders report decreased stocks and sales of foreign fruits. Nasir Uddin Mahmud of the Chattogram Fruit Traders Association noted that "current fruit prices had exceeded the reach of middle-class consumers," attributing this to import duties and associated costs.

Source: New Age