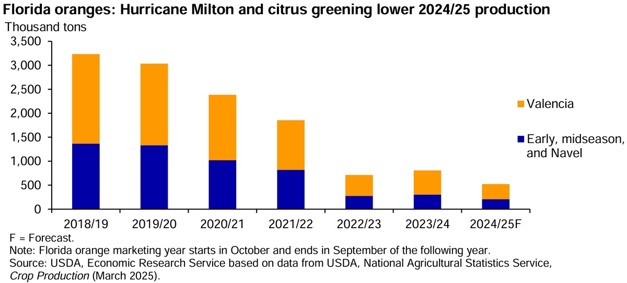

The most recent Florida all-orange crop forecast (March 2025) for 2024/25 is 522,000 tons, down 35 percent from the 2023/24 final utilized total of 808,000 tons. If realized, the 2024/25 Florida orange crop would be the smallest in 95 years. The USDA, National Agricultural Statistics Service (NASS) Crop Production report forecasts that Florida's combined early, midseason, and Navel orange production and Valencia orange production will fall 32 and 38 percent, respectively, compared to 2023/24.

In October 2024, Hurricane Milton ripped across the Florida peninsula and through prime citrus-producing counties. The storm caused millions of dollars in damage, dealing further blows to Florida's citrus industry already beset with challenges from the devastating botanical disease Huanglongbing (citrus greening). Despite considerable attrition of the State's citrus industry, Florida oranges continue to play a major role in the U.S. orange juice industry, accounting for 49 percent of the oranges used in domestic production in the 2023/24 season.

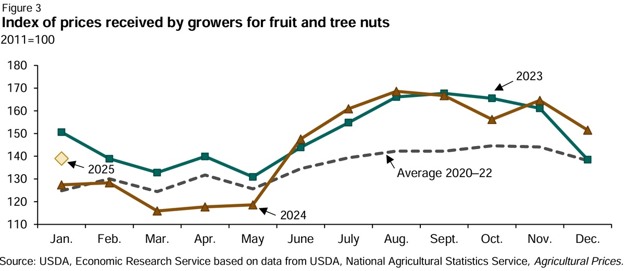

In January 2025, the index of prices received by growers for fruit and tree nuts was 139 (2011=100), about 9 percent higher than January 2024 but 8 percent lower than January 2023 (Figure 3). As in prior years, prices received by growers in 2024 increased in the late spring and early summer (June through August). This trend partially stems from the seasonal production of fruit and tree nuts. Grower prices for apples, strawberries, and grapefruit were higher in early 2025 than they had been in early 2024. Lower year-over-year volumes for nut crops like almonds, walnuts, and pistachios have also put upward pressure on grower prices.

The Consumer Price Index (CPI) for fresh fruit was reported at 418.9 (1982–84=100) in February 2025, up 2 percent from the same time last year (Figure 4). Apples and bananas are two of the most heavily weighted prices in the fresh fruit CPI, together accounting for about 34 percent of the index relative importance—more than three times the weight of the citrus fruit CPI (11 percent). The CPI for apples, which reflects changes in apple retail prices, was up 3.6 percent in February 2025 compared with February 2024 but lower than the same month in 2022 and 2023.

A larger apple harvest in fall 2023 put downward pressure on retail prices, which dipped to a 3-year low in April 2024. In February 2025, banana average retail prices fell below year-ago prices for a decrease of 1.3 percent. In the first 2 months of 2025, USDA Agricultural Marketing Service (AMS) banana shipment volumes were higher compared with the same period last year, despite slightly lower volumes from major suppliers Guatemala, Costa Rica, and Ecuador through the end of February.

To view the full report, click here.

For more information:

For more information:

USDA

Tel: +1 (202) 720-2791

Email: press@usda.gov

www.usda.gov