Annual global schedule reliability improved by 19.5 percentage points (PP) from 42.6% to 62.1% to 2023. Despite the sharp improvement, it only reached the level of 2020, and still below the 70%-80% of 2012-2019. What is concerning however, is that schedule reliability has declined M/M the entire Q4, and we are likely to see a similar impact for January 2024 due to the Red Sea Crisis.

This should be temporary though, once the additional transit time is accounted for in the carriers’ schedules, we will potentially see an improvement in schedule reliability. Lastly, the crisis came too late to have any significant impact on average delay, which improved from 6.38 to 4.83 days in 2023-FY.

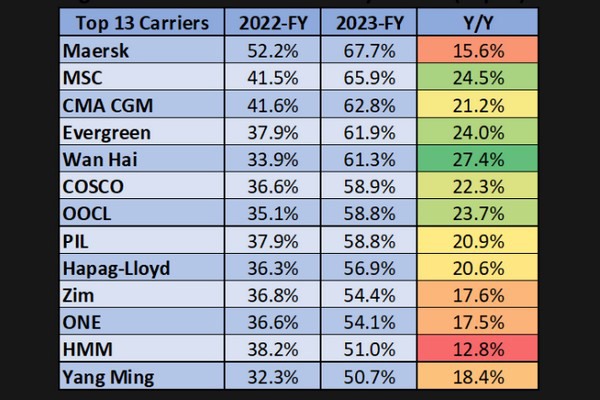

In terms of the global carriers, Maersk was the most reliable in 2023-FY with schedule reliability of 67.7%, followed by MSC (65.9%), CMA CGM (62.8%), Evergreen (61.9%), and Wan Hai (61.3%) as the only carriers above 60%. The remaining carriers had between 50% and 60% schedule reliability in 2023-FY, with Yang Ming at the bottom with 50.7%. All 13 global carriers recorded a double-digit Y/Y improvement, with Wan Hai recording the largest improvement of 27.4 PP.

Of the alliances, 2M was the most reliable at 57.8%, followed by Ocean Alliance (55.3%) and THE Alliance (43.1%). While all of them recorded double-digit Y/Y improvements, only 2M scored better than the industry average on the six major East/West trades. Those six trade lanes also recorded Y/Y improvements in schedule reliability in 2023-FY, however only the Asia-Mediterranean trade lane outscored the industry average on a trade lane level.

For more information: sea-intelligence.com