This year, the apple harvest is satisfactory in terms of both quantity and quality, while the pear harvest is growing, thanks in particular to summer varieties and new varieties arriving on the market. These harvest forecasts were presented to the entire sector (producers, wholesalers, distributors and manufacturers) on August 28th at the traditional annual launch of the French apple-pear campaign in Paris.

Photo credit: ANPP

Photo credit: ANPP

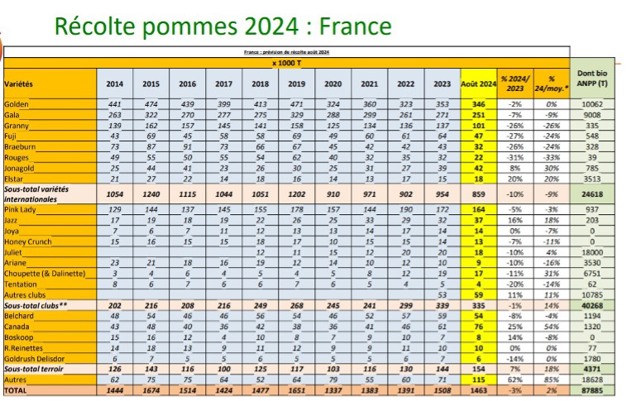

Apples: a satisfactory harvest with no excess

At 1.463 million tons, the 2024 harvest is virtually unchanged from the 1.508 million tons produced in 2023, and it is "satisfactory without being excessive," explains Vincent Guérin, head of economic affairs at ANPP. The harvest was therefore fairly close to average, but "did not reach its full potential."

In 2024, international varieties are down to 859,000 tons (-10%) from last year, while the Club and Terroir varieties are up. The decline is more marked for the Granny Smith (-26.3% compared to 2023) and Fuji (-27% from 2023, to 47,000 tons). The Golden crop remains stable (-2% from 2023, at 346,000 tons), while the Gala is down to 251,000 tons (-7% from 2023). Production of club varieties is stable (-1%). The Pink Lady harvested 164,000 tons (5% less than in 2023). The Jazz continues to grow (+16%), as are the Chantecler and new varieties.

While volumes are good for French apples, the European harvest shows a "historical deficit, being the second smallest of the decade in Europe," with 10.2 million tons for 2024 (1.3 million tons less than last year). Weather conditions have had an impact on Eastern Europe, and more specifically on Poland. Stocks were "a little heavy in July (73,347 tons), but this is not alarming, especially when you look at the European stocks (423,037 tons). We had set out to finish with a high stock on July 1st, but in the end we fell back in line," explains Vincent Guérin.

It has also been a promising campaign outside France, with more dynamic export sales (up 25,000 tons from last year). "It is nothing out of the ordinary, but we are no longer in the downturn of the last few years." France has regained market share in the EU, especially in the UK, but is losing ground in the Far and Middle East. On the other hand, South America would appear to be "a good outlet," since volumes are increasing.

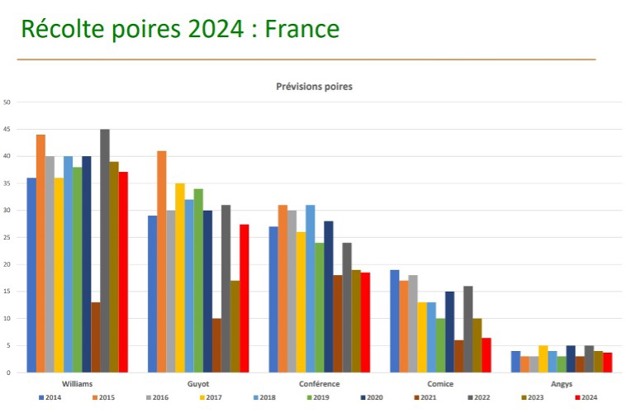

A growing pear harvest: abundance of summer varieties and new varieties

With a forecast of 119,000 tons of pears this year (compared to 104,000 tons in 2023), the French pear harvest is growing "without reaching full potential (average of 132,000 tons). It is also a long way from the 150,000 tons of the best years," according to Vincent Guérin.

The French harvest is therefore slightly up, showing "a certain dynamism" with the arrival of new varieties "which have yet to find their place on the market," and also thanks to larger volumes of summer pears such as the Guyot (27,000 tons, +61% from 2023), and the Williams. Autumn and winter pears, on the other hand, show a decline this year, especially the Conference pears, which are in short supply at the European level.

The indicators for France look favorable, especially in relation to the European harvest, which is "far from its potential, with 1.8 million tons expected." As with apples, it is "the second smallest crop of the decade."

"No promotional actions, no appalling margins"

"Producers did see an improvement in selling prices last year, but they are still not properly remunerated," explains the president of ANPP. Production costs remain high, as Xavier le Clanche, technical manager of ANPP explains. "Apples have never cost so much to produce." According to Daniel Sauvaitre, "prices paid to producers need to be increased by an average of €0.10/kg [0.11 USD/kg] to offset the inflation in production costs over the past 2 years. Likewise, this campaign launch is an opportunity for us to send a strong message to supermarket chains: 'No promotional actions, no appalling margins', so as to respect both the future of the orchards and consumers' wallets."

For more information:

Vincent Guérin

ANPP

[email protected]