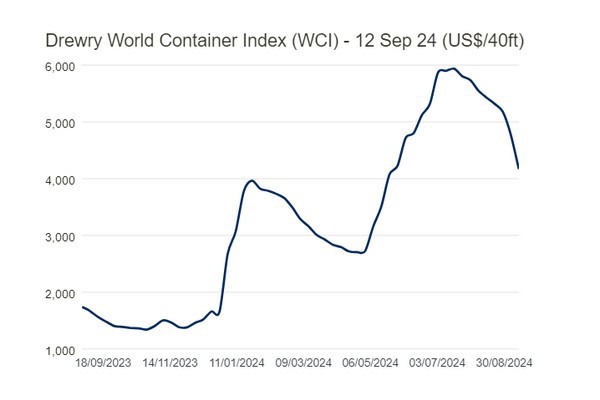

The World Container Index reported by Drewry experienced a 13% decline this week, dropping to $4,168 for a 40ft container.

Detailed assessment for Thursday, 12 September 2024

- The latest Drewry WCI composite index of $4,168 per 40ft container is 60% below the previous pandemic peak of $10,377 in September 2021, but it is 193% more than the average 2019 (pre-pandemic) rate of $1,420.

- The average composite index for the year-to-date is $4,128 per 40ft container, which is $1,310 higher than the 10-year average rate of $2,818 (inflated by the exceptional 2020-22 Covid period).

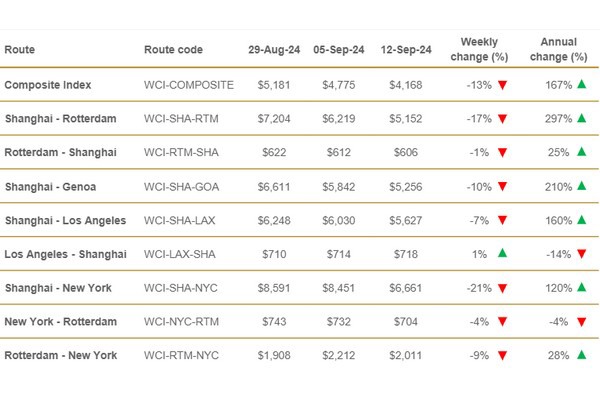

- Freight rates from Shanghai to New York plunged 21% or $1,790 to $6,661 per 40ft container. Similarly, rates from Shanghai to Rotterdam contracted 17% or $1,067 to $5,152 per feu. Likewise, rates from Shanghai to Genoa declined 10% or $586 to $5,256 per 40ft box. Also, spot rates from Rotterdam to New York dropped 9% or $201 to $2,011 per 40ft container. Moreover, rates from Shanghai to Los Angeles fell 7% or $403 to $5,627 per 40ft box. Additionally, rates from New York to Rotterdam eased 4% or $28 to $704 per 40ft. Also, rates from Rotterdam to Shanghai shrank 1% or $6 to $606 per feu. Conversely, spot rates from Los Angeles to Shanghai increased 1% or $4 to $718 per 40ft box. Shippers are transferring their cargo from the US East Coast to the West Coast to avoid the planned ILA strike in October, resulting in a drop in demand. This resulted in a huge 21% decline in East Coast spot rates. Due to weak demand, Drewry expects East-West rates to decrease further in the upcoming weeks.

Spot freight rates by route

For more information:

Drewry Shipping Consultants Limited

Tel: +44 (0)207 538 0191

Email: enquiries@drewry.co.uk

www.drewry.co.uk