The garlic market is facing numerous challenges. "Transport costs, the US dollar, quality, sizes, colors, labor, licenses, and many other issues," lists Danny Deen of Denimpex. In this article, he provides an update on the garlic market with a global perspective, covering the EU, South America, and the Far East.

Spanish season started with high prices

"Europe is dealing with several challenges in its growing areas, such as weather, labor costs, and transport. Spanish garlic producers had completely run out of stock this spring from previous seasons, something that hasn't happened in the past three years. The season began with high prices, and only smaller growers and packing stations sold garlic at lower prices due to their cash flow needs. However, these countries have now exhausted their stocks, leaving only the larger growers with some inventory. These larger growers are likely to allow prices to rise until the new season, as they are not under financial pressure," Danny explained.

"The other producers in Europe, such as France and Italy, are not major players in the European market but instead cater primarily to their domestic markets. They rely on imports from overseas or shipments of Chinese garlic from Dutch importers," he added. "Similarly, South American countries like Argentina, Chile, Mexico, Brazil, and Peru grow garlic mainly for their local markets and export based on yields and high prices in import markets like Canada and North America. They also target specialists in France and Italy, where Chinese garlic cannot be sold to supermarkets."

U.S. dollar near parity

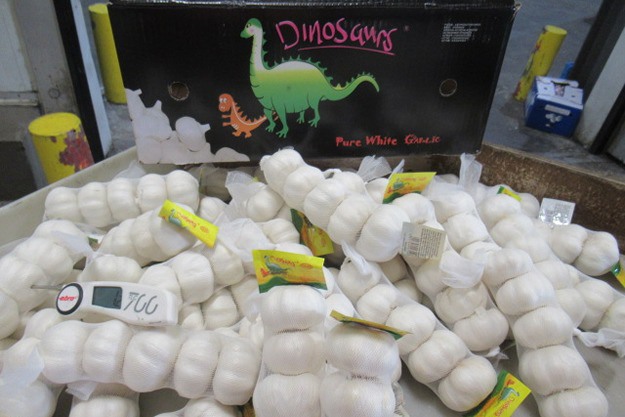

"China is a dominant global player in garlic, with an annual yield of 2.5 to 4.5 million tons. Since 1985, the EU has applied a quota system to protect European growers, and the US imposes a 400% import duty to safeguard its domestic producers. In China, the situation was largely the same this year. Old stocks in cold storage were depleted before the new season began, and while yields were not exceptional, the quality was good.

"Traditionally, many speculators are active in China's garlic stock market. However, due to poor investment returns, enthusiasm has waned significantly, leaving only large speculators in the market. These major players are less likely to panic than smaller ones, which has helped stabilize the Chinese market. Prices are expected to rise slightly during the season. However, this is also influenced by the US dollar, which is nearly at parity with the euro. If Trump takes office in January, the dollar might strengthen further," Danny said.

"Sea freight costs have risen significantly due to the dollar exchange rate and shipping routes passing through war zones. This has destabilized routes and increased insurance costs, further driving up freight rates," he continued. "With an annual supply of 60,000 to 70,000 tons to Europe, of which 40,000 tons can be sold within the EU by licensed importers, demand is exceeding the number of licenses and quotas. This has already led to substantial volumes being imported at fines of €1,200 per ton."

Immigrants consume more garlic than EU residents

As a result, traditional importers who previously received 100% of their reference quotas over the last three years are now only getting 95%. Prices must rise to compensate for importers' calculations, or there will be significant disruptions for supermarket suppliers with long-term programs. This is reminiscent of the situation seen during the COVID-19 pandemic.

"The 40,000-tons quota for EU licenses is likely to prove insufficient in the coming years, as Europe's population is growing rapidly due to immigration. Immigrants tend to consume significantly more garlic than the native EU population. All in all, importers are facing numerous challenges. However, given the current global situation, anything could still happen," Danny concluded.

For more information:

For more information:

Danny Deen

Denimpex

St. Antoniesbreestraat 10

1011 HB Amsterdam

Tel: +31 (0)20 624 63 90

[email protected]

www.denimpex.nl