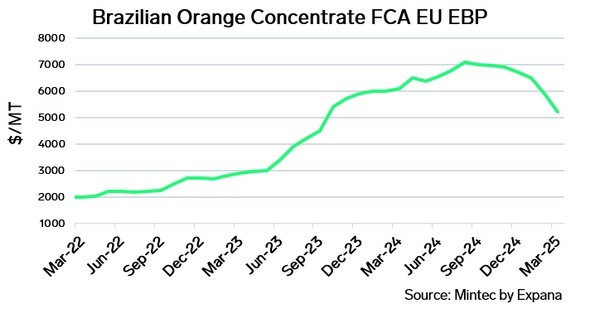

The Expana Benchmark Price (EBP) for frozen concentrated orange juice (FCOJ) FCA Europe fell to $5,200 per metric tonne (MT) by March 31, down by 11.9% month on month (m-o-m) and 26.8% below its August 2024 peak. The EBP for not-from-concentrate (NFC) orange juice stood at $1,250/MT, down by 6% m-o-m. While demand remains weak across the board, NFC prices have shown less volatility than FCOJ.

Brazil, which produces around 75% of global orange juice and processes approximately 80% of its orange crop, continues to dominate the export market. However, current demand conditions are described as "dire" by market participants, with limited trade activity prompting processors to lower prices. High shelf prices continue to weigh on consumption, and limited flexibility in retail contracts suggests little short-term relief for consumers. Initial concerns over supply shortages have eased, with expectations now that stocks will last until the next crop.

© Mintec/Expana

© Mintec/Expana

Click to enlarge

An improved outlook for Brazil's 2025/26 marketing year (MY) is driving the recent price declines. Early forecasts suggest the next crop could exceed 300 million boxes—a 31.5% year-on-year increase—though this figure is highly preliminary. Citrus greening remains a persistent risk to yields.

Egyptian orange juice is gradually gaining market share, but quality concerns persist, particularly around consistency in taste, color, and pesticide residue. Market participants remain bearish on the outlook, noting that regaining lost market share in the fruit juice markets will require significant effort following two years of elevated prices.

Source: Mintec/Expana